ShopRite pharmacies shut: ‘We thought we would be getting COVID vaccines here. And they told us we were all fired.’

Philly stores will sell wine and beer to replace some drug counters, Jeff Brown says.

Pharmacies in 62 ShopRite stores from Connecticut to Maryland are closing over the next month and rerouting customers to nearby CVS pharmacies. as the drugstore business continues to consolidate into a few giant chains.

ShopRite owner Wakefern Foods Corp., based in Woodbridge Township, N.J., has sold its customer lists to the Rhode Island-based CVS Pharmacy drugstore chain and reassigned them to CVS locations.

For example, patients who picked up prescriptions from the ShopRite at 52nd and Parkside in West Philadelphia are being sent to the CVS at 49th and Market Streets, nearly two miles away. Customers at an East Falls ShopRite are being sent to a CVS in Manayunk.

The closings include 22 in the Philadelphia area and parts of South Jersey and Delaware, according to a list provided by CVS. An additional 147 ShopRites will still have pharmacies, said spokesman Daniel Emmer.

Among the ShopRites with pharmacies remaining are three in Philadelphia: on Aramingo Avenue, at Bridge and Harbison Streets, and in Morrell Plaza.

For years, food markets aggressively added pharmacies to their stores, seeing them as draws for customers. But the stores have lately been closing them, lacking the market clout to strike deals for drugs or the walk-in clinics that attract many customers to big chain drugstores. CVS also owns Aetna, the third-largest U.S. health insurer, giving it extra market clout.

Neither CVS nor ShopRite’s owner would disclose how much CVS paid, how many employees work in the drugstores, or how many customers they serve. The deal does not require federal antitrust approval.

The pharmacists were summarily let go, according to customers in Philadelphia and New Jersey. “I found out about this today when I went to pick up my prescriptions in the Lyndhurst, N.J., ShopRite,” according to Eve Golden, a customer.

“My pharmacist was in tears — she told me, ‘We got a conference call last week and we were so excited, we thought we would be getting COVID vaccines here. And they told us we were all fired.’” Golden, who doesn’t have a car, says she doesn’t know how she’ll get to the CVS store in North Arlington, N.J., where she and other Lyndhurst customers have been reassigned.

Clerks and technicians, unlike the pharmacists, are represented by Local 1776 of the United Food and Commercial Workers Union, and “will be reassigned elsewhere in the store based on seniority and qualifications,” said union president Wendell Young.

ShopRite employees who want to stay in pharmacy “will be considered for positions at local CVS Pharmacy locations,” said CVS spokesman Matt Blanchette.

But the union’s Young doubted too many workers will make that choice: “CVS employees do not have a union contract and the pay and benefits at ShopRite are better.”

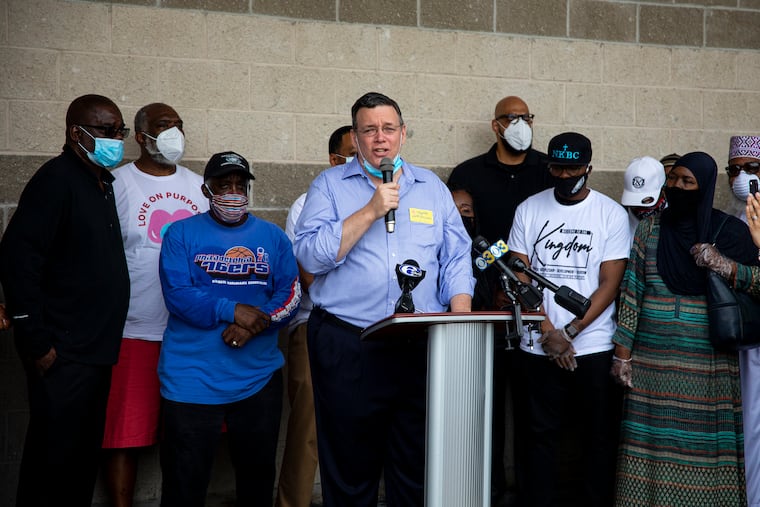

The closings will leave holes in the stores. Philadelphia-based ShopRite operator Jeff Brown says he has plans to fill the space quickly. “In my stores, we plan to use the space to add small, local businesses,” and to expand sales of wine and beer, said Brown, whose company, Brown SuperStores Inc., operates a dozen ShopRites in and near Philadelphia.

Philadelphia resident Tamekah Bost says she plans to open a restaurant at Brown’s Island Avenue store in Southwest Philadelphia. Better Box Twisted Eggrolls will combine the “Philly culture of cheesesteaks with our love of classic Chinese takeout,” Bost said.

NaKwai DeShield’s What a Crock, already at Reading Terminal Market, is testing its frozen foods at Brown’s Cheltenham store. Big Dean’s Hot Chicken is heading to the Roxborough store. Saladworks and UPS stores are also opening at one or more Brown ShopRites.

The move comes as CVS stores are implementing drive-through COVID-19 testing and preparing for mass coronavirus vaccinations, he said.

ShopRite in-store pharmacies had supplied prescription drugs to members of large health insurers under multiyear contracts, including a 2017 deal with Aetna, the third-largest U.S. health insurer with 22 million customers.

CVS Pharmacy owner CVS Health bought Aetna for $69 billion, in a deal finalized in 2019, despite opposition from the American Medical Association, which argued it would reduce competition, “leading to higher premiums and lower-quality insurance products.”

Soon after, CVS began moving ShopRite pharmacy customers from locations in New York state to its own stores. ShopRite operators in New York said they were getting out of the business due to low reimbursements from insurers and falling sales.

Drugstore operators have felt financial pressure to consolidate. For example, in 2015, CVS arranged to take over more than 1,600 in-store pharmacies at Target, the discount retailer and grocery chain, paying $1.9 billion for the locations and hiring 14,000 former Target workers.

The same year, Rite Aid, the Pennsylvania firm that is the third-largest operator of U.S. standalone drugstores, agreed to sell those operations to the largest operator, Walgreens (CVS is the second-largest). But that deal was scuttled amid fears the federal government wouldn’t approve such a large concentration. Instead, Rite Aid sold nearly half its stores to Walgreens but has remained in business as an independent company.

Among the grocers still offering in-store prescription sales in the Philadelphia area are drugstores at Wegmans markets, and some in the Malvern-based Acme chain, operated by Albertsons Inc., a publicly traded grocery and drugstore chain operator. Albertsons runs more than 1,700 U.S. pharmacies, including standalone Sav-On and Osco drugstores, plus hundreds of supermarket locations.

In 2018, Albertsons agreed to buy the remaining Rite Aid stores, which would have further concentrated drugstore ownership, but the deal fell through.