Judge dismisses Eagles’ lawsuit against insurer over economic losses from pandemic shutdowns

The lawsuit, filed against Factory Mutual, was dismissed following a Pennsylvania Supreme Court ruling in a similar case.

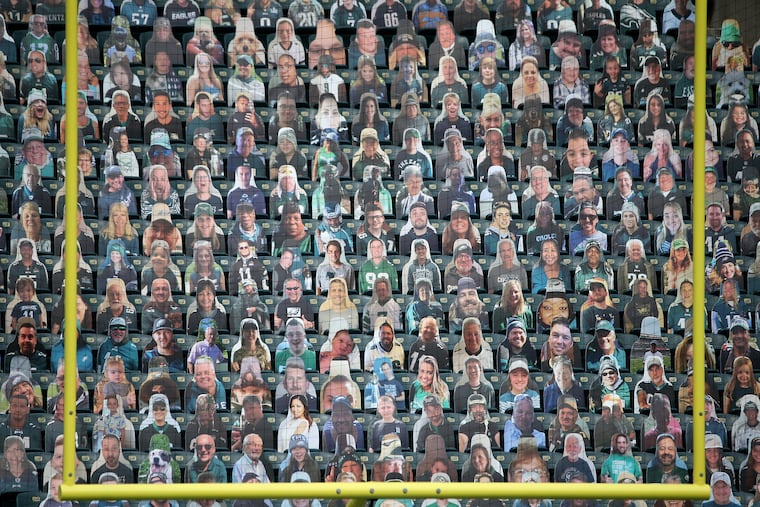

Cardboard cutouts of fans filled the stands at Lincoln Financial Field during Philadelphia Eagles games in fall 2020. The stand-ins for live, human fans perhaps made the empty stadium less jarring for TV viewers, but they didn’t pay for tickets, drinks, food, or merchandise.

To recoup some of these losses, the Eagles sued their insurance company, Factory Mutual arguing that the business disruption was covered by the “best-in-class” policy that the organization paid “top dollar” for.

But this week, a federal judge dismissed the case following a Sept. 26 Pennsylvania Supreme Court ruling that decided that business losses from government-ordered COVID-19 shutdowns aren’t covered by property insurance.

The Eagles were required to “close entirely” or “severely restrict” access to all indoor locations, including the NovaCare complex — the team’s headquarters and training facility — and the team merchandise stores, according to the lawsuit, which filed in March 2021 in the Philadelphia Court of Common Pleas.

And from August 2020 to January 2021, the Eagles were required to “cancel or significantly restrict” attendance to their home games at the Linc. Without the revenues from the games, stores, or hosting concerts and other events, the Eagles lost millions of dollars, according to the complaint. (It was later transferred to federal court)

“Fortunately, the Eagles purchased property insurance to protect against this type of catastrophic loss,” the lawsuit states.

The Eagles’ insurance policy with Factory Mutual covered up to $1 billion in losses, the lawsuit says, and the team argued that a pandemic is the type of event the policy is meant for. But the insurer was willing to only cover up to $1 million that the policy sets aside for pandemic response.

Factory Mutual argued that the policy covers “risks of physical loss or damage,” and that restricting the use of the Eagles’ properties doesn’t fall under that category, according to the insurance company’s filings.

Judge Michael M. Baylson, of the Eastern District of Pennsylvania, paused proceedings until the Pennsylvania Supreme Court issued its opinion on a similar matter.

And that ruling arrived last month, when the state’s Supreme Court decided a case involving the owner of dental practice with offices in the Pittsburgh area, Smile Savers Dentistry, and its insurers, CNA Insurance and Valley Forge Insurance Company.

Similarly to the Eagles, Smile Savers lost business because of government-issued orders in response to the COVID-19 pandemic in 2020. The Supreme Court justices concluded that the dentist was not entitled to the insurance coverage because he was able to use his properties, which were not physically damaged as the policy required.

“The only loss [the dentist] sustained, rather, was pure economic loss because the government-ordered COVID-19 shutdown prevented [him] from operating his Covered Properties at their full potential,” Justice Kevin Brobson wrote.

On Wednesday, Baylson dismissed the Eagles’ case, citing the Pennsylvania Supreme Court ruling.

“This Court stayed proceeding pending final rulings on whether Pennsylvania law would allow these claims to proceed, which was recently answered by the Pennsylvania Supreme Court in the negative,” Baylson wrote.

The Eagles and Factory Mutual declined to comment. Attorneys for the two organizations did not respond to requests for comment.