Using Philly as a bogeyman in the ‘burbs | Real Estate Newsletter

And a new voice at the land bank.

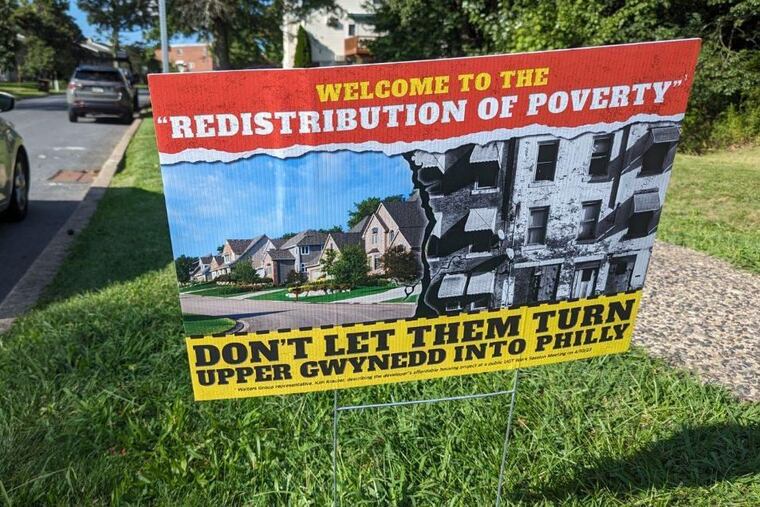

The lawn signs that popped up in a Montgomery County town were anonymous and meant to scare.

They warned that the town’s leaders were trying to “turn Upper Gwynedd into Philly.”

The signs are part of a fight in the town of 17,000 over a plan to build 60 below-market-rate apartments. It comes at a time when there’s a shortage of homes, especially ones that households can afford, both regionally and nationally.

The fight in Upper Gwynedd isn’t close to over.

Keep scrolling for that story and to find out why community groups are skeptical about someone just appointed to the Philadelphia Land Bank, peek into a contemporary rowhouse in Fitler Square, and see why an economist is impressed with the Philly-area real estate market.

📮 The next time I pop into your inbox, it’ll be Thanksgiving. If you’ll be hosting a get-together, what home feature makes your life easier? For a chance to be featured in my newsletter, email me.

— Michaelle Bond

If someone forwarded you this email, sign up for free here.

Affordable housing is a hot topic.

This summer, the Upper Gwynedd Township Board of Commissioners approved a New Jersey developer’s plan to build 60 apartments that will be offered at below-market rents.

The commissioners chose to allow the homes in an area designated for light industrial uses as part of an expanded transit-oriented district near a SEPTA line.

They faced — and continue to face — strong opposition from some residents. Opponents say Upper Gwynedd doesn’t need or want below-market-rate housing.

Some key quotes:

Denise Hull, president of the township commissioners: Some opponents “wanted us to make a moral judgment about ‘those people from Philly’ they said would be coming in [to live in the apartments], as if tenements from the 1800s were going to be built in Upper Gwynedd.”

Glenn Hatfield, a lead objector: “We believe what the commissioners [approved] was spot zoning, which is illegal. If they can spot zone there, they can spot zone anywhere. It’s setting a precedent that’s going to change the quality of life in Upper Gwynedd.”

Keep reading for more about the fight over the $25 million project, why Philly keeps getting mentioned, and how advocates say opponents are spreading disinformation.

Walking or driving around Philly, we’ve all passed empty lots with abandoned mattresses and fast-food trash and wondered what’s up with them.

Thousands of vacant lots in Philadelphia have the same owner: the city.

The Philadelphia Land Bank was created a decade ago to put to use all that publicly owned land. For example, I’ve written about the city’s Turn the Key program, which gives developers city-owned land so they can build price-restricted homes for first-time buyers.

At the land bank’s meeting this week, a prominent local developer joined as a board member instead of his usual role as an applicant trying to get his projects approved.

Mohamed “Mo” Rushdy, vice president of the influential Building Industry Association of Philadelphia, wants to get the land bank to work more efficiently. But community groups and other critics of his appointment are skeptical.

The latest news to pay attention to

Out of the 50 largest U.S. cities, Philly has the smallest home lots.

Baby boomers are buying up all the houses.

The former president of a powerful local union is accused of secretly billing the organization more than $65,000 for renovations on his New Jersey home and other properties.

Companies tied to Pennsylvania’s richest resident have taken over the Divine Lorraine from a developer who creditors say owes more than $100 million.

The University City Townhomes are set for demolition, but former residents say the fight to preserve affordable housing isn’t over.

Philly’s building trades union helped elect Cherelle Parker as the city’s next mayor.

Pennsylvania leads the nation for Lyme disease cases. Housing and other development in forests boosts the risk.

House of the week: For $510,000 in Fairmount, a three-bedroom townhouse.

Thanksgiving is almost here (Wasn’t it just Halloween??), and Sarah Pierce and Faiz Ahmad love hosting their holiday meal in their renovated rowhouse in Fitler Square.

Renovations took almost two years. The couple’s goal was to update the 30-year-old home with a more contemporary aesthetic while hanging onto the home’s natural light and open flow.

The couple’s kitchen was inspired by a kitchen shop they visited during a work trip to France. The shop featured cabinets with clean lines and built-in appliances. Their designer persuaded them to go with an induction cooktop.

The four-story, 3,300-square-foot house is near Schuylkill River Park and has a first-floor patio and fourth-floor deck. One of the couple’s favorite features is the curved staircase railing that spans all four floors.

The couple and their two young children moved from a two-bedroom condo nearby to the rowhouse in April 2020.

Peek inside the family’s home, which plays an important role in multiday Thanksgiving plans, and find out what happened when the remnants of Hurricane Ida caused water from the Schuylkill to pour inside.

🧠 Trivia time

A recent survey revealed the home features that apartment renters in the Philadelphia region want the most.

Question: Which of these was not one of the top 10 most desired features?

A) walk-in closet

B) hardwood or hardwood-like floors

C) in-unit washer and dryer

D) soundproof walls

This story has the answer.

📊 The market

The Philadelphia metro area still doesn’t have enough homes for sale, but buyers have been busy scooping up homes they see.

“The resiliency of the market in the face of mortgage rates approaching 8% has been impressive,” Lisa Sturtevant, chief economist at the multiple listing service Bright MLS, said in a statement.

The average interest rate for the popular 30-year fixed-rate mortgage hit 7.79% at the end of October.

Here’s some of what happened in the Philly-area market last month, with stats from Bright MLS:

🔻 Homes were on the market for a median of 11 days before a buyer claimed them. That’s down two days from October 2022.

🔺 The median sales price was $350,000. That’s up almost 8% from last October.

🔻 Active home listings — 10,602 — were down almost 10% from last October. But they were up almost 4% from last month, a positive sign.

Since October, mortgage rates have been trending downward. If they keep falling, we can expect more home buyers and sellers to get into the market.

But in the short term, the winter months are usually slow, and buyers may wait until spring, hoping for lower rates and more homes to choose from.

📷 Photo quiz

Do you know the location this photo shows?

📮 If you think you do, email me back. You and your memories of visiting this spot might be featured in the newsletter.

I’ll admit that last week’s photo was pretty hard. Shout out to Carlton S., who knew that it showed the historic Second Bank of the United States.

―

Do you believe in fortune telling?

Either way, let’s look together into the crystal ball of Lawrence Yun, chief economist at the National Association of Realtors. He’s predicting that mortgage rates will drop to between 6% and 7% by the spring and that sales of existing homes (so not newly built properties) will be up 15% nationally next year.

We’ll have to stay tuned to see how his predictions shake out.

Enjoy the rest of your week.

By submitting your written, visual, and/or audio contributions, you agree to The Inquirer’s Terms of Use, including the grant of rights in Section 10.