New kickback allegations rock the Par Funding fraud case

Steven Odzer, a businessman pardoned by President Trump for a $16 million bank fraud, has emerged as a leading figure in the SEC’s probe of Par Funding.

When they were exchanging millions of dollars, Stephen Odzer and Joseph LaForte would also trade compliments.

“Love you my friend and let’s make money together,” Odzer wrote in one email to LaForte. “We’re brothers. From different mothers!!” he said in another.

Said LaForte: “You are a good man and a friend.”

The well-connected Odzer dangled invitations before LaForte — to a 2016 bash for future Vice President Kamala Harris at the home of New York Mayor Michael Bloomberg. To Odzer’s 50th birthday in 2018 at the Center for Jewish History in Manhattan.

To be sure, Odzer and LaForte had something in common: prison terms for massive financial crimes. Main Line resident LaForte served time for a $14 million mortgage fraud and an illegal gambling operation. Odzer was sentenced to 18 months for a $16 million New York bank fraud.

In 2021, President Donald Trump pardoned Odzer amid a big wave of clemency orders on his last day in office. Trump, in an official statement, said Odzer’s pardon was driven by his charitable deeds and supported by several political allies.

Now, Odzer and LaForte are both facing filed or proposed lawsuits in perhaps the most remarkable subplot that has unfolded from the Par Funding investment scandal in Philadelphia. The court-appointed receiver in the case — and Odzer himself — says the businessman paid $9 million in cash “kickbacks or commissions” to Par Funding founder LaForte to borrow $93 million.

The men’s apparent friendship is over. Through his lawyers, LaForte calls Odzer’s allegations “fantastical” and “bizarre,” a concoction cooked up by Odzer to avoid the debt he ran up borrowing for his businesses selling office and cleaning supplies.

In 2020, in its original sweeping civil suit, the U.S. Securities and Exchange Commission said that lender Par Funding, founded in Philadelphia, gulled 1,200 investors in a $540 million scheme run by LaForte, his wife, and others.

Alleging one of the biggest financial frauds in recent Philadelphia history, the SEC said that Par Funding and its financial pitchmen misled investors by hiding LaForte’s criminal background and his firm’s reckless lending, high loan defaults, and regulatory troubles.

On Friday, LaForte’s lawyers disclosed in a court filing that they expect him to be indicted on federal charges that could include securities fraud, wire fraud, tax offenses, money laundering, extortion, and obstruction.

Par Funding loaned money to smaller businesses at high interest rates, sometimes as high as 400%. This in turn permitted Par Funding to promise generous returns to investors. In lawsuits,borrowers say that the firm was ruthless in its collection tactics and that both LaForte, 51, and his younger brother, James, 45, made threats to collect loans.

James LaForte has his own convictions for financial fraud, loan-sharking, gambling, and arson. Lawyers for the LaFortes have denied they threatened others.

Attorney Ryan Stumphauzer, the receiver appointed by the federal judge in the SEC case, is trying to claw back millions for Par’s investors. He has recently unveiled the alleged kickbacks flowing from Odzer to LaForte, citing emails and text messages as evidence. The two men traded many messages, sometimes just as friends, other times to discuss Odzer’s push to borrow more money.

The receiver says Odzer, 53, was Par Funding’s biggest borrower by far. To get the loans, the receiver says he paid kickbacks to LaForte more than 250 times over four years. He would have his driver drop off the cash.

Though the emails show Odzer ponying up without complaint, his lawyers now say he was victimized by the LaForte brothers. A report prepared for Odzer’s lawyers contends that, completely aside from the loan kickbacks, James LaForte “effectively stole” $1.5 million from Odzer by selling him worthless personal protective equipment during the COVID-19 epidemic.

Help us make our Business coverage better for you: We may change parts of the Business section and need your help. Complete our anonymous survey and you can enter to win a $75 American Express gift card.

Agents found $2.5 million in cash in LaForte’s homes

The receiver’s recent filings, prepared with the help of Philadelphia lawyer Gaetan Alfano, shed new light on another mystery: the extraordinary amount of cash the FBI seized in raids on Joseph LaForte’s three homes.

Shortly after the SEC sued Par Funding, agents searched Joseph LaForte’s houses on the Main Line, in the Poconos, and on the Gold Coast of Florida. Agents seized seven handguns and rifles. He is to be tried in Philadelphia in October on charges of illegal possession of firearms by a felon.

But, as Stumphauzer notes in court documents, the agents also found $2,532,885 stashed among the three houses.

Lawyers for Joseph LaForte concede that Odzer made millions in payments in cash. “However,” they wrote in a legal filing, “the evidence is clear that these payments were not kickbacks,” but rather were “properly recorded on Par’s books.”

Odzer’s lawyers say he was simply making loan payments. “That’s all he knows. He had no idea why part of it had to be in cash,” said lawyer Shane Heskin. “That was a condition of getting the money. He didn’t have a choice. He really didn’t know why. It didn’t really matter.”

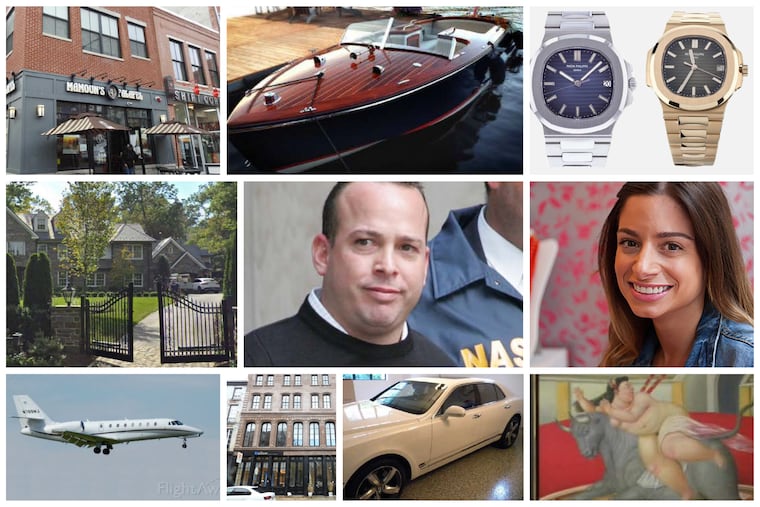

The receiver hopes to use that cash, as well as Joseph LaForte family’s assets ranging from a jet to an $88,000 watch, to repay the investors whom the SEC says were defrauded. In all, the receiver says that LaForte and his wife, Lisa McElhone, took out about $125 million from Par.

LaForte and McElhone, a nail salon owner from South Philadelphia, along with other Par Funding players have largely dropped their legal fight against the SEC, though they have not conceded wrongdoing. A federal judge is now determining how much the SEC can attempt to seize from them.

In its suit against the lender, the SEC said Joseph LaForte used three aliases to fool people. In his exchanges with Odzer, he went by the name Joe Macki.

Criminal pasts

The LaFortes have a multigenerational criminal history.

Joseph and James LaForte’s late grandfather was alleged by federal prosecutors to have been a captain in the Gambino crime family run by John Gotti in New York. Joe “The Cat” LaForte owned the Little Italy building that housed the Ravenite social club presided over by Gotti. In a story that drew tabloid headlines, the body of a murder victim was found dumped in a candy store owned by the grandfather.

The two brothers, their father and mother, and a sister were all convicted on state charges in a $14 million mortgage fraud on Long Island in 2006. Prosecutors said the family set up a fake law firm and ran a Ponzi scheme stealing money entrusted to them for home purchases. They spent their gains on a home in Miami Beach and cars, including a Corvette, a Rolls-Royce, and a Bentley.

Joseph LaForte had one more conviction. In 2009, he pleaded guilty in New Jersey to helping run an illegal offshore gambling operation at about the same time as the mortgage ripoff. His 10-month federal term was concurrent with the state sentence of at least 3½ years for the mortgage fraud.

His lawyer, Joshua Levine, declined to comment.

James LaForte has a more complicated criminal past. After his arrest in the mortgage scam, he had more convictions for loan-sharking and arson attacks on borrowers. In one case, his five codefendants in Brooklyn were Mafia members, including an acting mob boss, federal officials said in 2012.

He was behind bars until 2015 or so. After that, he began collecting debts for Par Funding, which his brother had founded in 2011 after his own release from prison.

Both brothers are alleged to have threatened borrowers. Federal prosecutors in Joseph LaForte’s pending firearms case said he told one small-business borrower that he would “blow up your house,” and asked another whether she “had ever heard of cement shoes.”

In a lawsuit, a large Par Funding debtor made public text messages in which James LaForte cursed him with a sexual epithet and threatened to show up at his house, adding “it’s a surprise who ever I pop up on.” Lawyers for the brothers reject the allegations of threats.

James LaForte, who now lives in Gloucester County, could not be reached for comment. In a legal filing, his lawyer acknowledged that the younger Forte sometimes called himself James McElhone, using the last name of his sister-in-law.

A Trump pardon

As for Stephen Odzer, he lives near Las Vegas and runs a dozen or so companies, the biggest of which appears to be B&T Supply, a firm with offices in Long Island that sells office and cleaning supplies. He sometimes identifies himself as Tzvi Odzer.

In numerous internet postings by public relations firms and Odzer himself, he is portrayed as an entrepreneur and philanthropist who started his first business at age 18 out of his parents’ home in Flatbush in New York.

In 2002, Odzer was 33 when federal prosecutors went to court in New York against him in a criminal case. He pleaded guilty to defrauding three banks. Prosecutors said his businesses couldn’t meet expenses and he faked financial papers and made “illicit payments” to bank employees to get loans. In charging papers at the time, prosecutors identified him as Harold Odzer.

In 2007, he was given an 18-month sentence and ordered to pay the banks $16 million. He left prison in 2008 at age 40 and resumed his business career.

On Jan. 19, 2021, Trump removed the stain of the conviction. The pardon still required Odzer to make restitution. The status of his payments is not public.

In a pardon message, Trump praised Odzer for visiting children in hospitals and for donating religious material to prisoners and soldiers. It said advocates for the pardon included Wayne Root, a right-wing radio host who won notoriety for falsely blaming the mass killings by a gunman in Las Vegas in 2017 on a “Muslim terror attack.”

The White House message said another booster was former acting U.S. Attorney General Matt Whitaker, whom Trump put in that post in late 2018 for several months.

As the Daily Beast has reported, the conservative group FreedomWorks paid Whitaker $400,000 in 2020 to lead a campaign to “recommend deserving individuals to the Trump administration for pardons and commutations.”

Peter Vicenzi, spokesperson for FreedomWorks, said that Odzer was not among those the group had supported and that Whitaker had apparently done that on his own. Whitaker did not return email messages to his “Liberty & Justice” podcast.

In 2020, the year before the pardon, Odzer sharply upped his political giving. He donated more than $50,000 to national Republican organizations, four times more than in any previous year.

Odzer also hired Kristina Wildeveld, a prominent Las Vegas criminal defense lawyer, to push for his pardon, lobbyist records show. Wildeveld, who recently applied to trademark the phrase “Pardon Me,” did not return calls.

Clawing back money

In filings this year in the SEC’s civil case against Par Funding, receiver Stumphauzer got permission to sue both Odzer and the LaForte brothers over the millions they allegedly took in kickbacks.

The receiver sued the brothers in Philadelphia Common Pleas Court in March and is expected to file a similar suit against Odzer shortly.

Lawyers for the LaForte brothers on Friday asked a judge to delay the new civil suit for at least six months. They argued that it would be unfair for them to have to fight both this civil case and what they said was a coming federal criminal prosecution focused on Par Funding.

According to a financial analysis for Odzer cited by the receiver, Odzer’s firm borrowed about $93 million from Par and repaid about $72 million. The receiver contends that with interest Odzer still owes $91 million. The receiver quoted Odzer as telling Par in emails that he needed to borrow heavily “to keep my balances high” to line up more funding from others.

Odzer’s lawyers say the debt is dramatically less, under $10 million.

So far, receiver Stumphauzer and Alfano have gained control of about $150 million in cash, real estate, and other valuables from Joseph LaForte, his wife, and other key Par Funding players. While the lender made some repayments to investors before its operations ended in 2020, the receiver must find another $100 million or so to make them whole, records show.

Par Funding first lent money to Odzer’s companies in 2015. It kept on lending to him, even though his firms almost immediately fell behind in payments and were bouncing checks. Much of Par Funding’s lending was in the form of “reloads” — new loans to pay back old ones.

By 2020, Odzer’s firm owed tens of millions. It owed Par more than $100,000 in daily payments, the receiver noted, using italics.

Starting in 2016, the cash receiver says Joseph LaForte started getting cash payments from Odzer. Stumphauzer and Alfano said they only ended in 2020 — with the last one delivered the day before the SEC brought its lawsuit.

Emails and texts obtained by the receiver document the cash exchanges.

“I will be in Phily next Wednesday or Thursday and drop off 25k in cash,” Odzer wrote on March 16, 2016.

The following month, Odzer asked about a new loan and said he could provide cash to LaForte. “Just let me know and my driver will drop off the cash,” Odzer said.

In 2018, he wrote: “Joe. Hi my friend. Hope you had a great weekend. Just got a call that I can pick up over 100k cash tomorrow so I will drop off by you on Wednesday.”

In a 2020 message, he urged LaForte to have his brother contact one of Odzer’s staffers: “Have jimmy call Rhonda. She’ll give him 50k.”

As Odzer’s debts grew, his email exchanges with Joseph LaForte grew testy. At one point, LaForte became upset when Odzer pleaded for a break on a loan. He wrote Odzer that “when a business man underestimates, he eats it. … He doesn’t call his creditor and friend.

“You have incredible income with this and I helped get your there. Why am I being penalized. I have a business to run and this is killing me. You’re the last guy I should have to worry about. I trust you and now I am starting to wonder if you know what you are doing. You realize u owe me 80 million dollars, right??”

In rebuttal pleadings, Joseph LaForte’s lawyers argued the cash was properly passed into Par Funding corporate books. However, accounting records that are part of the court file list only $1.9 million in cash as booked into corporate accounts, not the $9 million the receiver says was paid out.

Joseph LaForte’s lawyers say that the receiver was distorting his relationship with Odzer, which they describe as completely professional.

As for the invitations, they said LaForte didn’t accept them. “Mr. LaForte has never been to Mr. Bloomberg’s house,” his attorneys wrote.

In addition, the lawyers cited the pardon, noting that Trump had praised Odzer for giving away personal protective gear.

“Mr. Odzer was a good businessman and got a pardon for his work saving lives, which he could not have done without Par’s advances,” the lawyers said.

More recently, though, Joseph LaForte’s team has taken a far less positive view of Odzer.

“Odzer’s tale is fantastical and makes zero sense and it is bizarre that the receiver is buying it and attempting to proceed in such manner,” they wrote in one filing late last year. “It is obvious that the receiver is once again swerving outside his lane in an attempt to dirty up LaForte.”

Odzer’s lawyers have replied in kind. Said attorney Richard Sapinski: “We think Mr. Odzer was victimized like all the others.”